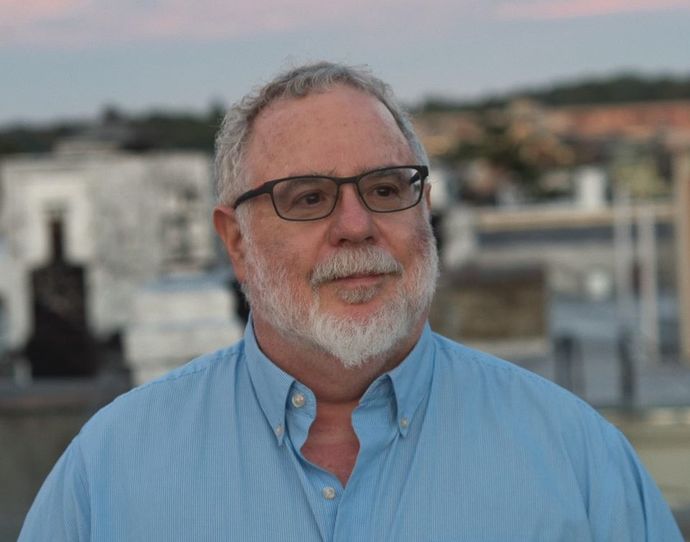

Jon Lukomnik

Forbes calls long-time institutional investor Jon Lukomnik one of the pioneers of modern corporate governance. Jon is the managing partner of Sinclair Capital LLC, a strategic consultancy to institutional investors, and a Senior Fellow at the High Meadows Institute. He was the Pembroke Visiting Professor at the Judge Business School at Cambridge for the winter 2020 semester.

Jon is the co-author with Dr. James Hawley of “Moving Beyond Modern Portfolio Theory: Investing That Matters” (Routledge 2021). It has received widespread praise as the first unified theory of investing that examines why investors should care about — and try to influence — systemic risks that cause non-diversifiable risk in the capital markets.

Jon has been the investment advisor or a trustee for more than $100 billion (including New York City’s pension funds) and has consulted to institutional investors with aggregate assets of nearly a trillion dollars. He served for more than a decade as the executive director of the IRRC Institute. He currently is a member of the Deloitte Audit Quality Advisory Committee, the Standards and Emerging Issues Advisory Group of the Public Company Accounting Oversight Board, and a trustee on the Van Eck mutual funds, insurance trusts and European UCITs. Jon co-founded the International Corporate Governance Network (ICGN) and GovernanceMetrics International (now part of MSCI)

His previous books include What They Do With Your Money, and “The New Capitalists”, which was a Financial Times pick of the year. Both were co-written with Stephen Davis and David Pitt-Watson. In total, Jon has written more than 200 academic and practitioner articles. He has been honored by the ICGN, Council of Institutional Investors, Ethisphere, the National Association of Corporate Directors (US), Transparency Task Force, and Global Proxy Watch, among others.